Allied Solar System Finance 2026

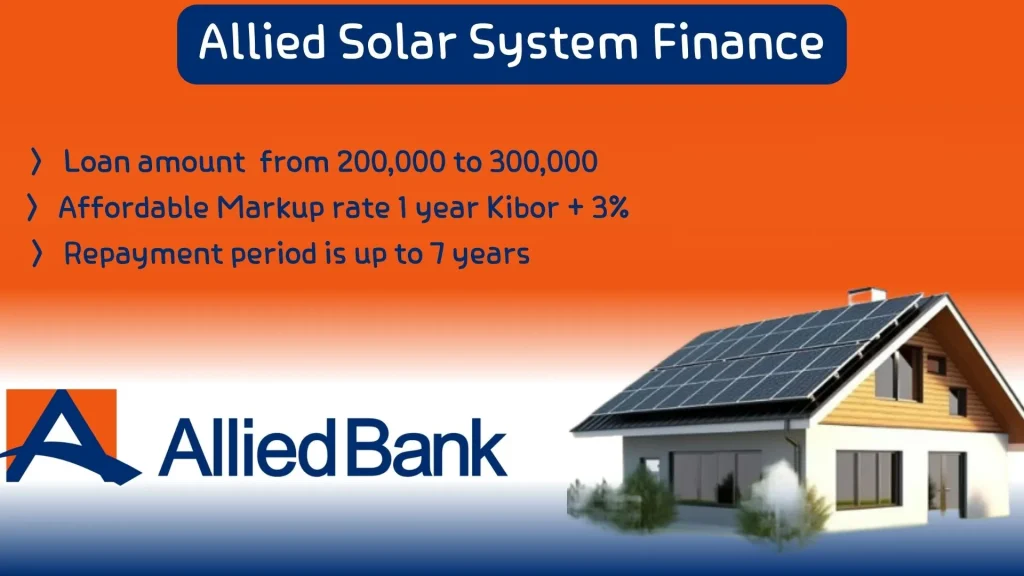

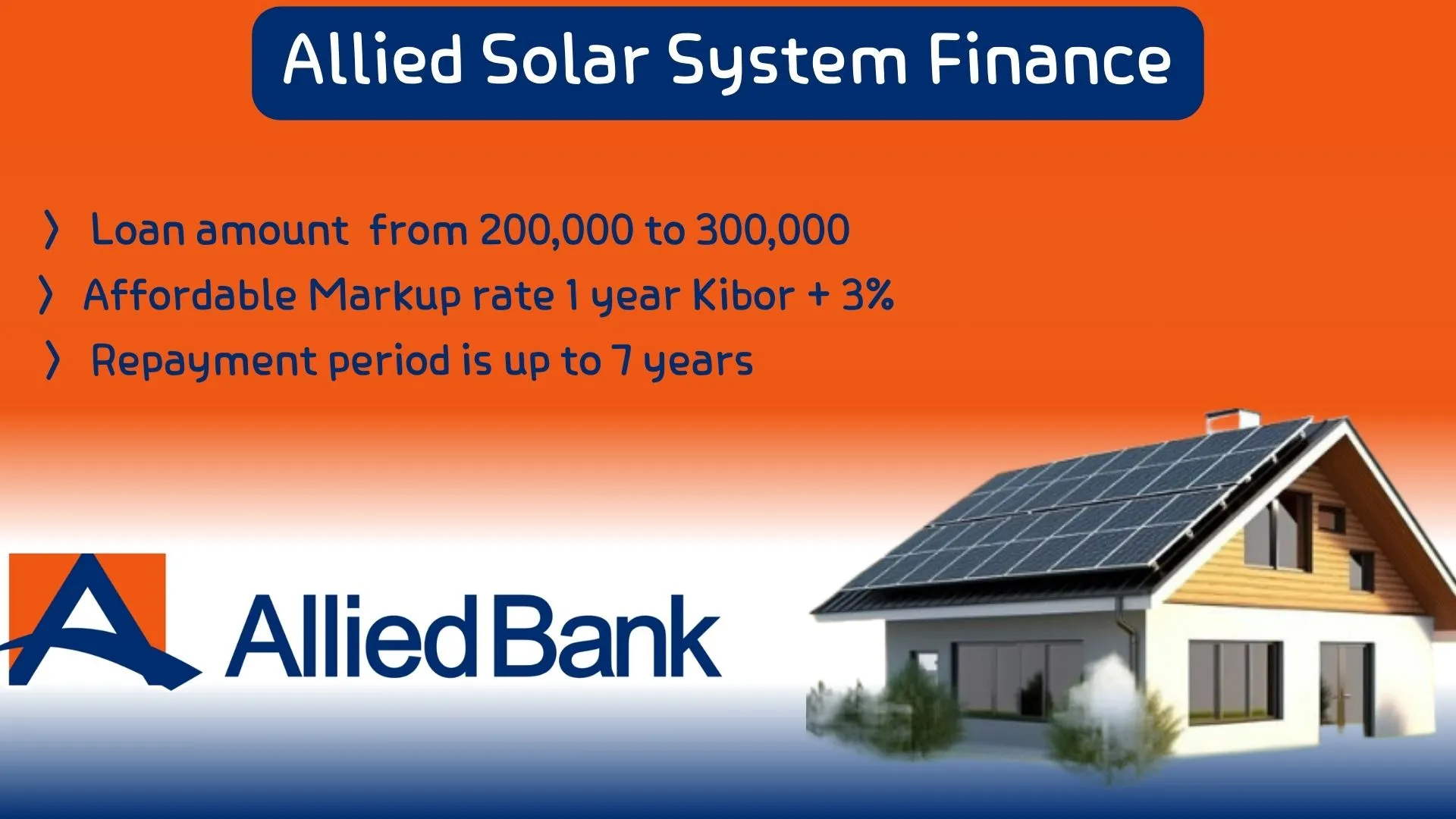

Allied Solar System Finance is a solar financing product of Allied Bank in Pakistan. Like many other banks, Allied Bank Pakistan is also saying goodbye to high electricity bills and hello to sustainable green energy. Under the State Bank of Pakistan’s financing scheme, Allied Bank offers solar loans at low markup rates to consumers of solar panels. Allied Solar System Finance is a loan facility provided by Allied Bank Limited (ABL) in Pakistan, designed to help homeowners install solar energy systems through manageable monthly instalments. It offers a practical solution to rising electricity costs and unreliable power supply, allowing consumers to embrace clean energy without a heavy upfront investment. Solar panel customers can easily apply by visiting any Allied Bank branch in Pakistan.

What is Allied Solar System Finance?

Allied Solar System Finance offers a consumer-friendly financing program that enables individuals and businesses to purchase and install solar energy systems without the full upfront cost. Instead, customers can spread the payment over easy monthly instalments while immediately benefiting from reduced electricity bills. Unlike conventional loans, this facility is specifically tailored for solar energy projects and comes with flexible terms, ensuring affordability for both middle-class households and commercial clients.

Allied Solar System Finance Features & Benefits

Allied Solar System Finance Eligibility Criteria

Allied Solar System Finance Documents

How Can I Apply For Allied Solar System Finance?

Why Does Solar Financing Matter in Pakistan?

Conclusion

Allied Solar System Finance is paving the way for affordable and sustainable energy solutions in Pakistan. By offering flexible financing options, they enable homeowners and businesses to adopt solar power without incurringhighy upfront costs. This approach not only supports clean energy growth but also reduces dependence on conventional electricity, ultimately helping customers save money while protecting the environment. With their reliable financial plans and commitment to renewable energy, Allied Solar System Finance is making solar energy accessible for everyone. By choosing Allied Solar Financing, you’re not only cutting down your electricity bills but also contributing to a cleaner, greener, and more energy-independent Pakistan.

Frequently Asked Questions About Allied Solar Finance

What is Allied Solar Finance?

Allied Solar Finance offers flexible financing options for solar energy systems, enabling customers to pay in affordable instalments rather than ahight upfront cost.

Who can apply for Allied Solar Finance?

Both residential and commercial property owners in Pakistan can apply, provided they meet the bank’s eligibility criteria, such as income verification and credit assessment.

How can I apply for Allied Solar Finance?

Applications can be submitted through Allied Bank branches or on their official website, where customers must provide basic documents and financial details.

What is the interest rate for Allied Solar System Finance?

Under SBP’s Refinancing Scheme: As long as the State Bank of Pakistan’s refinance scheme is available, Allied Bank offers a fixed 6% per annum markup rate for solar financing.

Very helpful for solar financing

Thanks